The book which contains a classified and permanent record of all the transactions of a business is called Ledger. Here are the ledger account class 11 notes.

Topics Discussed

Advantages of Ledger

- All the transactions about an account are collected in one place in the ledger.

- Any type of information relating to the business can be easily obtained from the ledger.

- A trial balance can be prepared with the help of a ledger.

- Trading and profit and loss A/c and Balance Sheet can also be prepared with the help of a ledger.

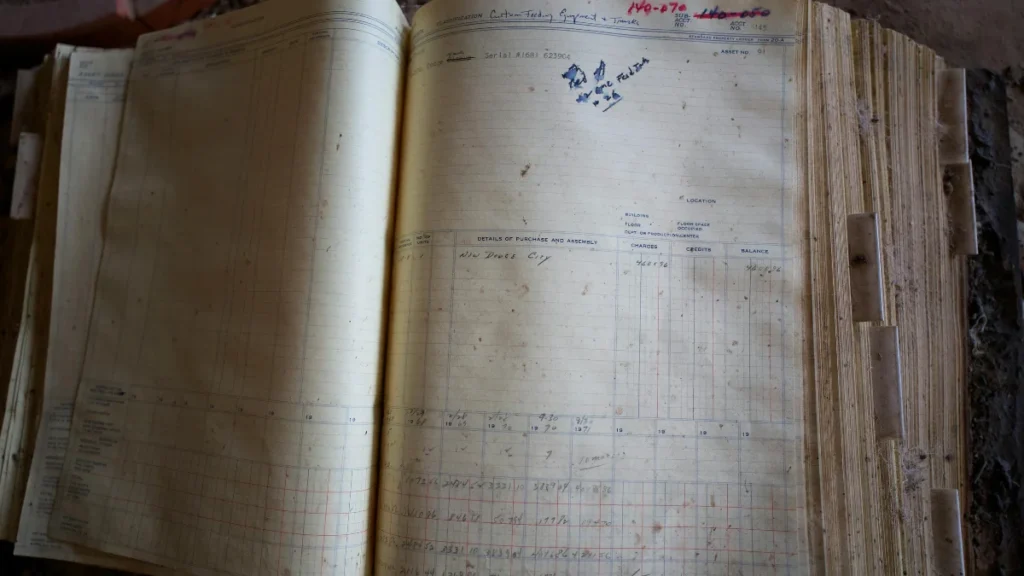

Format of Ledger Accounts

Name of Account

| Date | Particulars | JF | Amount (Rs.) | Date | Particulars | JF | Amount (Rs.) |

| Total | Total |

Opening Entry

The first entry in each year’s journal is to record the opening balances of various assets and liabilities at the beginning of the new year.

Compound Journal Entry

When in a journal entry, two or more accounts are debited and only one account is credited or vice versa the entry is termed as compound journal entry.

Computerized Accounting System Class 11 Notes

Journal Vs. Ledger

| Journal | Ledger |

| As the name indicates, all the transactions are first of all recorded in the journal. They are also referred to as the book of primary entry. | All the transactions entered in journal or subsidiary books are then transferred to the ledger. It is also referred to as the book of final entry. |

| Transactions are recorded in chronological order, as of when they take place. | In this book, transactions are recorded in an analytical order i.e. all the transactions of a particular account are contained in one place in the ledger. |

| Full details of transactions (narrations) are recorded in these books. | Full details of transactions are not recorded in the ledger. |

| Final Accounts ( Balance Sheet) cannot be prepared with the help of books of original entry. | Final Accounts can be prepared with the help of ledger accounts. |

| The process of recording entries is called journalising. | The process of recording entries is called posting. |

| Page number of the ledger i.e. ledger folio (LF) written in these books. | The page number of the journal books i.e. journal folio (JF) is written in the ledger. |

| Accuracy cannot be tested. | Accuracy can be tested by preparing a trial balance. |

Journal

A journal is a book of original entries in which transactions are recorded in the order in which they occur i.e., in chronological order.

Opening Entry

It is a compound entry that carries forward all the balances of assets and liabilities of the previous year to the current year.

Compound Journal Entry

Sometimes, two or more transactions relating to one particular account take place on the same date. In such cases, only one entry is passed instead of passing separate entries for all such transactions.

Format of Journal

| Date | Particulars | L.F. | Debit(Rs.) | Credit(Rs.) |

Difference between Trade Discount & Cash Discount

| Basis | Trade Discount | Cash Discount |

| Meaning | Trade discount is allowed by wholesalers or manufacturers to retailers at a fixed percentage on the printed price list. | A cash discount is allowed if the customer makes the payment immediately within a fixed period. |

| When allowed | It is allowed when goods are purchased in a specified quantity. | It is allowed when payment is made on or before a specified date. |

| Object | It is allowed to attract customers. | It is allowed to encourage quick or prompt payment. |

| Recording in the books of accounts | It is not recorded separately in the books of accounts. | It is recorded separately in the books of accounts. |

| Deduction from invoice | It is deducted from the invoice. | It is not deducted from the invoice. |

Rebate

A rebate is also a kind of discount but it is provided to the buyer of goods for reasons different than that of which trade discount and cash discount is provided.

The reasons for providing rebates can be poor quality of goods, goods are not as per specifications, etc.

These are the ledger account class 11 notes accountancy. If you have any doubt, you can either join my telegram channel or comment below.