Excess demand is when aggregate demand is more than aggregate supply corresponding to a full employment level of output in the economy. Here are the excess demand and deficient demand class 12 notes.

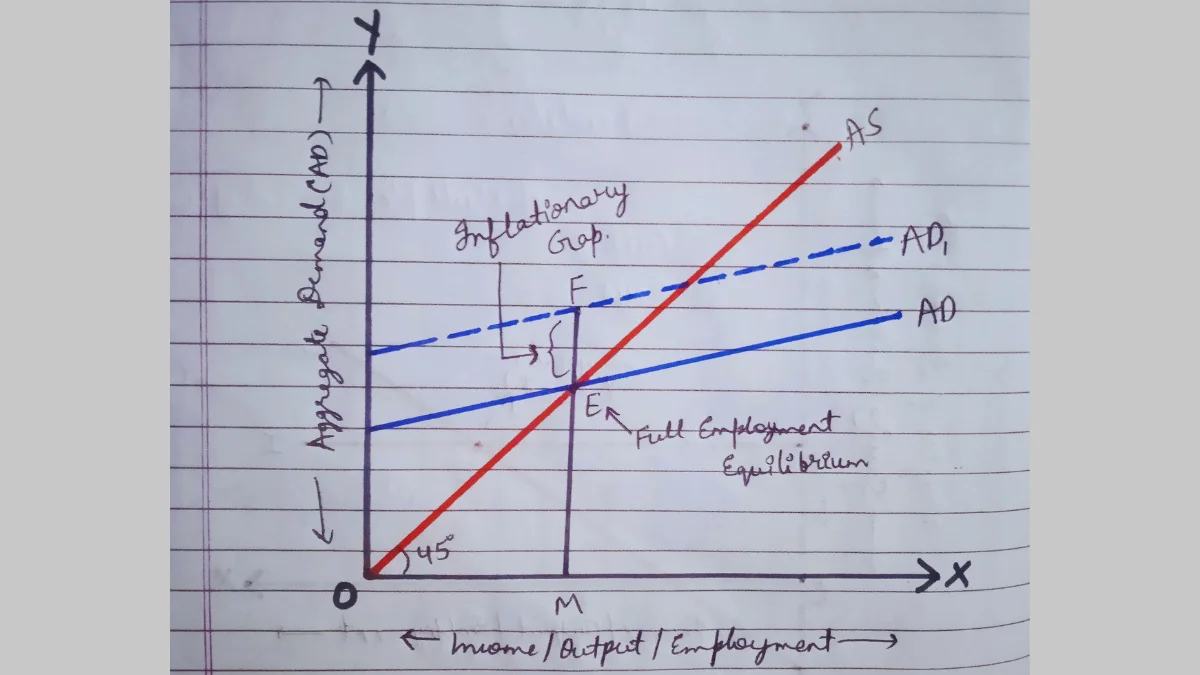

- Income/Output/Employment is measured on the x-axis & AD is measured on the Y-axis.

- AD & AS curve intersect at point E which indicates full employment equilibrium.

- Due to an increase in investment expenditure, AD rises from AD to AD1.

- It denotes the situation of excess demand & the gap between them i.e., EF is termed as an inflationary gap.

- Inflationary gap refers to the gap by which actual aggregate demand exceeds the aggregate demand required to establish full employment equilibrium.

Topics Discussed

Reasons for Excess Demand

1) Rise in Propensity to Consume

Excess demand may arise because of an increase in consumption expenditure due to a rise in the propensity to consume or a fall in the propensity to save.

2) Reduction in Taxes

It may also occur due to an increase in disposable income & consumption demand because of a decrease in taxes.

3) Increase in Government Expenditure

A rise in government demand for goods & services due to an increase in public expenditure will also result in excess demand.

4) Fall in Imports

A decrease in imports due to higher international prices in comparison to domestic prices may also lead to excess demand.

5) Rise in Exports

Excess demand may also arise when demand for exports increases due to comparatively lower prices of domestic goods or due to a decrease in an exchange rate for domestic currency.

6) Deficit Financing

Excess demand may be caused due to an increase in the money supply caused by deficit financing.

Impact of Excess Demand

Excess demand has the following effects on output/employment & general price level.

- Effect on Output: Excess demand does not affect the level of output because the economy is already at full employment level & there is idle capacity in the economy.

- Effect on Employment: There will be no change in the level of employment as the economy is already operating at full employment equilibrium & there is no involuntary unemployment.

- Effect on General Price Level: Excess demand leads to a rise in the general price level known as inflation as aggregate demand is more than aggregate supply.

Deficient Demand

Deficient demand refers to a situation when aggregate demand(AD) is less than aggregate supply(AS) corresponding to a full employment level of output in the economy.

Explanation

- Income/output & employment is measured on the x-axis & AD is measured on the y-axis.

- Aggregate demand & aggregate supply curves intersect each other at point E which indicates full employment.

- Due to a decrease in investment expenditure, aggregate demand falls from AD to AD1.

- It denotes the situation of deficient demand & the gap between them i.e., EG is termed a deflationary gap.

- The deflationary gap is the gap by which actual aggregate demand falls short of the aggregate demand required to establish full employment.

- Point F indicates the underemployment equilibrium.

Reasons for Deficient Demand

1) Decrease in Propensity to Consume

A decrease in consumption expenditure due to a fall in the propensity to consume leads to deficient demand in the economy.

2) Increase in Taxes

AD may also fall due to the imposition of higher taxes. It leads to a decrease in disposable income & as a result, an economy suffers from deficient demand.

3) Decrease in Government Expenditure

When the government reduces its demand for goods & services due to a fall in public expenditure it leads to deficient demand.

4) Rise in Imports

When international prices are comparatively less than domestic prices it may lead to a rise in imports implying a cut in aggregate demand.

5) Fall in Exports

Exports may fall due to comparatively higher prices of domestic goods or due to an increase in the exchange rate for domestic currency. This will lead to deficient demand.

Impact of Deficient Demand

Generally, deficit demand adversely affects the level of output, employment & general price level in the economy.

- Effect on Output: Due to a lack of sufficient aggregate demand, inventory stock will increase. It will force the firms to plan lesser production for subsequent periods. As a result, the planned output will fall.

- Effect on Employment: Deficient demand causes involuntary unemployment in the economy due to a fall in planned output.

- Effect on General Price Level: Deficient demand causes a general price level to fall due to a lack of demand for goods & services in the economy.

Difference Between Excess Demand and Deficient Demand

| Basis | Excess Demand | Deficient Demand |

| Meaning | It refers to a situation when AD is more than AS corresponding to full employment level in the economy. | It refers to a situation when AD is less than AS corresponding to full employment level in the economy. |

| Gap | It leads to an inflationary gap. | It leads to a deflationary gap. |

| Equilibrium level | It indicates an overfull employment equilibrium. | It indicates an underemployment equilibrium. |

| Impact on Price | It leads to inflationary i.e. a rise in the general price level. | It leads to deflation i.e. fall in the general price level. |

| Reason | It occurs due to excess of anticipated expenditure i.e., due to rise in consumption expenditure, investment expenditure, etc. | It occurs due to the shortage of anticipated expenditure i.e. due to a fall in consumption expenditure, investment expenditure, etc. |

| Impact on Output & Employment | It does not affect the output and employment as an economy is already operating at full employment level. | It leads to a fall in output & employment due to the shortage of AD. |

Measures to Control Excess & Deficient Demand

There are several measures to control excess and deficient demand.

Change in Government Expenditure

This measure is a part of fiscal policy & is termed as an expenditure policy of the government. The govt. spends a huge amount on public works like the construction of roads, flyovers, buildings, railway lines, etc.

Changes in such expenditure directly affect the level of AD in the economy & help to control excess demand & deficient demand.

Change in Taxes

Taxes are the main source of revenue for govt. This measure is a part of fiscal policy & is termed as the revenue policy of the government.

Changes in taxes by govt. directly influence the level of AD in the economy & help to control excess & deficient demand.

Change in Money Supply or Availability of Credit

RBI is empowered to regulate the money supply in the economy through its monetary policy. It is a policy of the central bank to control the money supply & credit creation in the economy.

Monetary policy helps to control the situation of excess & deficient demand through the following instruments:

Quantitative Instruments

These instruments aim to influence the total value of credit in the circulation & includes:

- Bank Rate and Repo Rate

- Open Market Operations

- Legal Reserve Requirements

Qualitative Instruments

These instruments aim to regulate the direction of credit & include:

- Margin Requirements

- Moral Suasion

- Selective Credit Controls

Measures to Correct Excess Demand

During excess demand current AD in the economy is more than the full employment level of output. It happens because of a rise in money supply & availability of credit at easy terms.

To correct excess demand the following measures may be adopted:

Govt. Expenditure

It is a part of fiscal policy. The government spends a huge amount on infrastructural & administrative activities. To control the situation of excess demand govt. should reduce its expenditure to the maximum possible extent.

Decrease in govt. spending will reduce the level of AD in the economy & help to correct inflationary pressure in the economy.

Increase in Taxes

During excess demand govt. increases the rate of taxes & even imposes some new taxes. It leads to a decrease in the level of aggregate expenditure in the economy & helps to control the situation of excess demand.

Income Determination and Multiplier Class 12 Notes

Decrease in Money Supply

The central bank aims to reduce the availability of credit through its monetary policy. For this purpose two major instruments are used:

Quantitative Instruments

1) Increase in Bank Rate

The bank rate is the rate at which the central bank lends money to commercial banks to meet their long-term needs. During excess demand, the central bank increases the bank rate, which raises the cost of borrowing from the central bank.

It forces commercial banks to increase their lending rates discourages borrowers from taking loans & ultimately helps them to correct excess demand.

2) Open Market Operations

Open market operations refers to the sale & purchase of securities in the open market by the central bank.

During excess demand, the central bank offers securities for sale which reduces the reserves of commercial banks & adversely affects the bank’s ability to create credit & decreases the level of AD in the economy.

3) Increase in Legal Reserve Requirements

Commercial banks are obliged to maintain a legal reserve. An increase in such reserve is a direct method to reduce the availability of credit. It includes:

- CRR (Cash Credit Ratio): It is the minimum percentage of net demand & time liabilities to be kept by commercial banks with the central bank.

- SLR (Statutory Liquidity Ratio): Statutory liquidity ratio is the minimum percentage of net demand & time commercial banks with themselves.

To correct excess demand, the central bank increases CRR and SLR. It reduces the amount of effective cash resources of commercial banks & limits their credit-creating power which ultimately helps in reducing the availability of credit in the economy.

Qualitative Instruments

1) Margin Requirements

It refers to the difference between the market value of securities offered & the value of the amount lent.

When the economy is suffering from excess demand, the central bank increases the margins that restrict the credit-creating powers of banks & decreases the level of aggregate demand.

2) Moral Suasion

It is a combination of persuasion as well as pressure that the central bank applies on other banks in order to get the act in a manner or line with its policy.

During excess demand, the central bank advises, requests, or persuades commercial banks not to advance credit for speculative or non-essential activities. It helps to reduce the availability of credit or aggregate demand.

3) Selective Credit Control

It refers to a method in which the central bank gives direction to other banks to give or not give credit for certain purposes to a particular sector.

During excess demand, the central bank introduces rationing of credit to prevent excess flow of credit particularly for speculative activities. It helps to wipe off excess demand.

All Formulas

- Y = C+S

- AD = C+I

- APC = C/Y, 1-APS

- APS = S/Y, 1-APC

- MPC = delta C/delta Y, 1-MPS

- MPS = delta S/delta Y, 1-MPC

- C = c(bar)+b(Y)

- S = -c(bar)+(1-b)Y

- K = delta Y/delta I

- K = 1/1-MPC, 1/MPS

[…] Excess Demand and Deficient Demand Class 12 Notes […]