Source documents are those documents that are used by an organization as an evidence of a transaction. Here are the source documents class 11 notes.

Topics Discussed

Cash Memo

When a trader sells goods for cash, he gives a cash memo; when he purchases goods for money, he receives a cash memo. Details regarding the item, quantity, rate, and total price are mentioned in the cash memo.

Invoice and Bill

When a trader sells goods on credit, he prepares a sale invoice containing the name of the party to whom goods are sold, the rate, quantity, and the total sale amount.

The original copy of the sale invoice is sent to the purchaser and its duplicate copy is kept for making records in our books or accounts.

Receipt

When a trader receives cash from a customer, he issues a receipt containing the date, amount, and the customer’s name.

The original copy of the receipt is given to the customer and its duplicate copy is kept for making records in the books of accounts.

Debit Note

When we return goods to a supplier, we prepare a debit note and send it to the supplier with the returned goods.

It is a source document containing the transaction date, the name of the account that is debited, the amount, and the reasons for debit.

Credit Note

When goods are received back from a customer, a credit note is sent to him indicating that the customer’s account has been credited to our books. A duplicate copy of the credit note is retained for record purposes.

Pay-in-slip

This is a form available from a bank and is used to deposit money in the bank. Each pay-in-slip has a counterfoil which is returned to the depositor duly stamped and signed by the bank’s cashier.

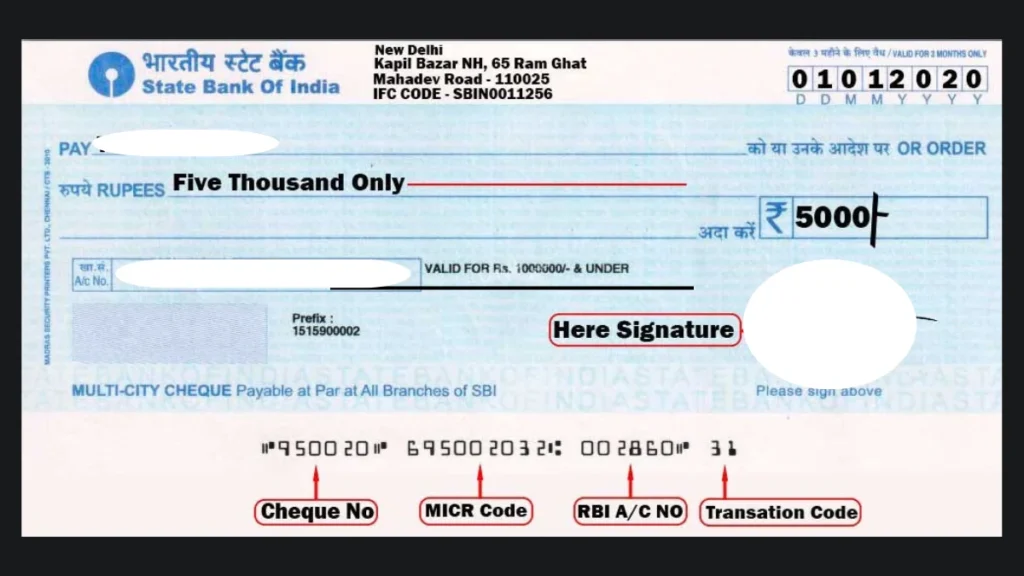

Cheque

A cheque is a written order drawn upon a bank to pay a specified sum to the bearer or the person named in it. Each chequebook has a counterfoil in which the same details as entered in the cheque are filled.

Voucher

Vouchers are printed separately by all the firms in their own names. A separate voucher is prepared for each transaction, specifying the accounts to be debited and credited.

Difference between Source Documents and Vouchers

| Source Document | Vouchers |

| It is a support to the voucher. | The voucher is supported by a source document. |

| It is not prepared to record transactions. | It is prepared for the purpose of recording transactions. |

| It contains full details of a transaction. | It puts emphasis on which account is to be debited and which account is to be credited. |

| It is evidence of the transaction. | It is a document of correct recording of a transaction. |

Types of Vouchers

1) Cash Vouchers

Cash vouchers are prepared for cash transactions i.e., cash receipts and payments. These are two of two types viz., Debit vouchers and Credit Vouchers.

a) Debit Vouchers

These are prepared for transactions involving cash payments such as:

- For cash payment of expenses

- For cash purchases of goods

- For cash purchases of investments

- For cash purchases of fixed assets

- For cash payments to creditors

- For depositing cash in the bank

Contents in Cash Voucher:

- Date of preparing voucher

- Serial number of voucher

- Name of the account debited

- The net amount of the transaction

b) Credit Voucher

These are prepared for transactions involving cash receipts such as:

- For cash receipts of income

- For cash sales of goods

- For cash sales of investments

- For cash sales of fixed assets

- For cash receipts from debtors

- For withdrawing cash from the bank

Contents in Credit Voucher:

- Date of preparing voucher

- Serial number of voucher

- Name of account credited

- The net amount of the transaction

Accounting Principles Class 11 Notes

2) Non-Cash Vouchers or Transfer Vouchers

These vouchers are prepared for non-cash transactions such as:

- For credit purchase or credit sale of goods

- For credit purchase or credit sale of investments

- For credit purchase or credit sale of fixed assets

- For return of goods purchased or sold on credit

- For providing depreciation

- For writing off bad debts

Content of Non-Cash Vouchers:

- Date of preparing voucher

- Serial number of voucher

- Name of account debited and name of account credited

- The net amount of the transaction

Compound Voucher

A compound voucher is a document showing a transaction containing multiple debits and one credit or multiple credits and one debit. Thus a compound voucher may be of two types:

- Debit Voucher: A document showing a transaction that contains multiple debits and one credit is called a debit voucher.

- Credit Voucher: A document showing a transaction that contains multiple credits and one debit is called a credit voucher.

[…] Source Documents Class 11 Notes […]

[…] Source Documents Class 11 Notes […]